Money Management for a Single Parent

As a single parent, you’re probably familiar with the dual challenges of managing a household and planning for the future on your own. But are you as familiar with the financial strategies that can stretch your income and help you get ahead? Consider the following lessons to help improve your family’s bottom line.

As a single parent, you’re probably familiar with the dual challenges of managing a household and planning for the future on your own. But are you as familiar with the financial strategies that can stretch your income and help you get ahead? Consider the following lessons to help improve your family’s bottom line.

Lesson #1: Identify Your Goals

You can’t have a financial plan without first defining your financial goals. Start by recording all of your short-, medium-, and long-term goals.

For example, paying for a child’s education could be one of the biggest expenses in your future. During the 2014/2015 school year, the average total cost of one year in a private college was $42,419. At the average public college, it was $18,943. If expenses continue to rise at their current rate, a college education could exceed $300,000 (private) or $140,000 (public) by the year 2030.1

Retirement is another important goal. Most financial planners suggest accumulating enough of a nest egg so that — when combined with Social Security and pension payments — it will provide at least 80% of your final working year’s salary during each year of retirement. To determine how much you may need for retirement, consider using one of the many free, online retirement planning calculators.

Lesson #2: Be a Better Budgeter

To pursue your family’s goals, it’s necessary to manage your household’s cash flow. That involves tracking income and spending, eliminating unnecessary costs, and living within the confines of a realistic budget.

For example, if you spend $1.50 each day on a take-out coffee, that amounts to about $45 each month. By eliminating that minor expense from your budget, you could easily save an additional $500 per year.

Lesson #3: Say No to Debt

High-interest credit card debt can make it extremely difficult to get your budget in order. If you have an outstanding balance, consider paying it off as aggressively as possible. The savings in interest alone could allow you to address other important financial goals.

Consider this: The average credit card balance of U.S. adults is $5,596; interest rates typically average over 12%. If you made only the minimum monthly payments on such a debt at a 12% annual percentage rate, it would take years to pay it off, and you would spend thousands in interest in the process.2

It’s also a good idea to review your credit history — commonly referred to as your credit report — to make sure that the information it contains about your past use of credit is accurate.

Lesson #4: Learn About Savings and Investment Opportunities

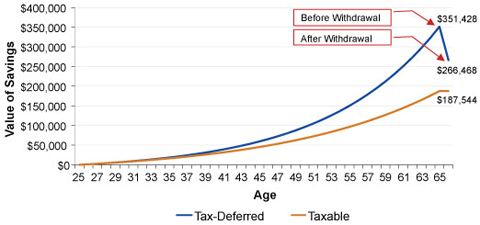

Once you free up some cash, apply it toward your goals. But first, learn about the savings and investment opportunities available to you. Keep in mind that tax-deferred investment accounts may enable you to “grow” the value of your assets more significantly than taxable accounts. That’s because investment gains in taxable accounts are taxed every year, while those in tax-deferred accounts remain untaxed until you make withdrawals later in life.

- Employer-sponsored plans, such as traditional 401(k) plans, allow workers to set aside a portion of their pretax income in a company-sponsored, tax-deferred retirement account. As an added benefit, some employers make a “matching contribution” to employees’ accounts each time employees contribute.3

- Traditional individual retirement accounts (IRAs) may allow you to deduct a portion of annual contributions from your taxes (depending on your income) and offer tax-deferred investment growth. Roth IRAs do not offer a tax break for contributions, but investment earnings are untaxed and qualified withdrawals are tax free.3

- Coverdell Education Savings Accounts (formerly known as Education IRAs) allow tax-free earnings on nondeductible contributions of up to $2,000 annually. Qualified withdrawals may be used to pay for college, as well as elementary and secondary schooling.3

- Section 529 college savings plans are state-sponsored investment programs that allow tax-free withdrawals for college expenses. College savers who contribute to their home state’s 529 plan may be eligible for state tax breaks. If your state or your designated beneficiary’s state offers a 529 plan, you may want to consider what, if any, potential state income tax or other benefits it offers before investing.3

Once you’ve selected an appropriate investment account, you’ll then need to determine an appropriate investment strategy. In general, stocks have the most short-term risk, but they also have the potential to generate better long-term returns than money market or bond investments. Therefore, the longer your investment time frame, the more you may want to rely on stock investments to pursue your financial objectives.

| To obtain and review a copy of your credit report, visit annualcreditreport.com or contact the following companies: |

|

Lesson #5: Get Professional Advice

A financial professional can suggest specific strategies for you and point out any considerations you may have overlooked, such as insurance, estate planning, or tax planning.

Always ask how — and how much — a professional charges for his or her services. To locate a financial professional, check your local yellow pages or contact The Financial Planning Association at 1-800-322-4237.

Remember, successfully managing the finances of a one-parent household takes time and dedication. But once you begin to see an improvement in your family’s bottom line, you’ll know it’s worth the effort.

Points to Remember

- To begin establishing your entire range of priorities, divide your goals into one of three categories: short term, medium term, or long term.

- Don’t procrastinate about getting your financial life in order. Cut back on wasteful spending immediately and channel the extra money to your most pressing needs. If big expenses are in your future, start learning what it will take to accomplish them. That could mean signing up to participate in an employer-sponsored retirement plan, or researching financial aid for college.

- Consider working with a financial professional at least one time for input into how you may better manage your finances and plan for the future.

- Break the credit card habit. Consider transferring balances to lower interest rate accounts, and pay off existing debts aggressively. Check to ensure that the information in your credit history is accurate.

- Search for fun, low-cost ways to spend family time together. Ask the children for ideas.

Source/Disclaimer:

1Sources: The College Board; Wealth Management Systems Inc. Private and public college cost projections assume 4% annual increases, which were the average increases at all private and public colleges for the 2014/2015 year.

2Source: Creditcards.com, Credit Card Statistics, November 2014. Amount excludes zero balance cards and store cards.

3Nonqualified withdrawals are subject to income and/or penalty taxes. Restrictions, penalties, and taxes may apply. Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted.

Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2015 Wealth Management Systems Inc. All rights reserved.