Longevity Risk and Retirement Income

How long might you live in retirement? Think carefully. Your answer could influence whether you have enough money for a comfortable retirement or just scrape by.

How long might you live in retirement? Think carefully. Your answer could influence whether you have enough money for a comfortable retirement or just scrape by.

According to pension mortality tables, at least one member of a 65-year-old couple has a 72% chance of living to age 85 and a 45% chance of living to age 90.1 This suggests that many of us will need to plan carefully to ensure that we don’t outlast our assets.

Live Long and Prosper

The first step in tackling longevity risk is to figure out how much you can realistically afford to withdraw each year from your personal savings and investments. You can tap the expertise of a qualified financial professional to assist you with this task. Or, you can use an online calculator to help you estimate how long your money might last.

One strategy is to withdraw a conservative 4% to 5% of your principal each year. However, your annual withdrawal amount will depend on a number of factors, including the overall amount of your retirement pot, your estimated length of retirement, annual market conditions and inflation rate, and your financial goals. For example, do you wish to spend down all of your assets or pass along part of your wealth to family or a charity?

Protecting Your Retirement Paycheck

No matter what your goals, there are ways to potentially make the most out of your nest egg. The remainder of this article examines how a strategy might play out with assets held in taxable accounts.

First, you’ll likely need ready access to a cash reserve to help pay for daily expenditures. A common rule of thumb is to keep at least 12 months of living expenses in an interest-bearing savings account, though your needs may vary.

Then, consider refilling your cash reserve bucket on an annual basis by selectively liquidating different longer-term investments, timing gains and losses to offset one another whenever possible.

Developing a Diverse Income Strategy

Responding to the current interest rate environment is one way to potentially squeeze more income from your savings and stretch out the money you’ve accumulated for retirement. For example, if rates are trending upward, you might consider keeping more money in short-term Certificates of Deposits (CDs).2 The opposite strategy may be employed when rates appear to be declining.

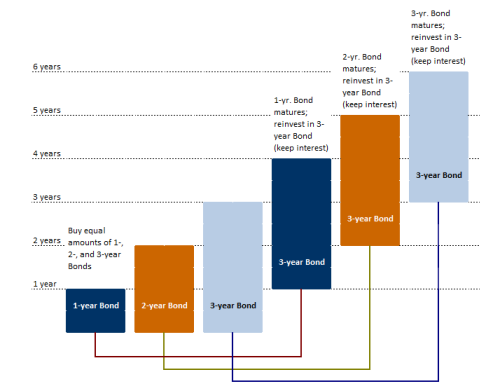

Most retirees need their investments to generate income. Bonds may help fill this need. “Laddering” of bonds can potentially create a steady income stream while helping reduce long-term interest exposure (see illustration).

| Building a Bond Ladder |

|

| “Laddering” bonds is a popular strategy used by income investors. This strategy involves buying an assortment of bonds of different maturities and staggering the maturities over time. In the above example, an investor initially buys bonds with maturities of one, two, and three years. As each bond matures, it is reinvested in another three-year bond to retain the staggered bond ladder. Total yield (income) is potentially higher than if continually reinvested in one-year maturities. Risk is also potentially reduced due to investing in a mix of maturity rates. |

A common way to help temper investment risk is to spread it out by diversifying among different types of securities. A retiree seeking income can use the same strategy by adding dividend-paying equities to his or her portfolio.

These stocks potentially offer the opportunity for supplemental income by paying part of their earnings to shareholders on a regular basis. Another potential attraction? Qualified stock dividends are currently taxed at a maximum rate of 20%, rather than ordinary federal income tax rates, which currently run as high as 39.6%. Also, keep in mind that investing in an equity-income mutual fund, which generally holds many dividend-paying stocks, may help reduce risk compared with investing in a handful of individual stocks.

Adding Annuities to the Mix

One way to potentially provide regular income and address longevity risk is to purchase an immediate annuity. In exchange for giving an insurer a specific amount of money, you’re guaranteed income for either a specific period of time, or life. Keep in mind, however, that guarantees are backed by the claims-paying ability of the issuing company. There are many types of annuities, so speak with a financial professional to carefully weigh your options, and be sure to examine fees and other charges before buying.3

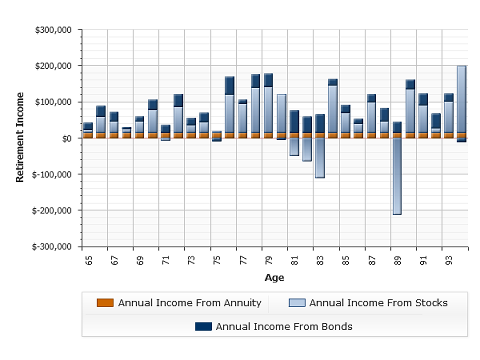

The chart shows how adding an annuity could potentially increase the odds that your money will last your lifetime. One tactic is to figure out your annual expenses and determine how much income you’ll receive from Social Security and pensions (if any). Then, consider purchasing an annuity that will make up any shortfall. This allows peace of mind, knowing that your regular expenses are covered. Then, you can put your other investments to work pursuing growth.

Accounting for Growth

Finally, be cautious about being overly conservative with your investments. Many people may live 30 or more years in retirement. Therefore, your portfolio may need a boost of stocks to outpace inflation over the years.

These are just a few ideas for developing an adequate income plan during retirement. Consider sitting down with a qualified financial professional to discuss these and other strategies that might be appropriate for your situation.

| Stretching a Retirement Portfolio |

| An annuity may potentially help provide stability and longevity to a retiree’s income.3 This hypothetical example illustrates how long a $500,000 portfolio would last for someone who retired in 1984, based upon a portfolio comprised of 25% stocks, 25% bonds, and 50% invested in a lifetime annuity, assuming an annual withdrawal rate of $30,000, adjusted for inflation. Returns assume reinvestment of dividends and capital gains if any. |

|

| Sources: Wealth Management Systems Inc. Performance is based on the 30-year period ended December 31, 2013. Stocks are represented by the total returns of the S&P 500, which is generally considered representative of the U.S. stock market. Bonds are represented by the total returns of the Barclays U.S. Aggregate Bond Index, generally considered representative of the U.S. bond market. Both are unmanaged indexes. Inflation is represented by the change in the Consumer Price Index. Fixed annuity assumed to earn a 6% annual rate. Individuals cannot invest directly in any index. Past performance does not guarantee future results. Example is hypothetical and for illustrative purposes only. Annuities involve risks and fees. Talk to your financial advisor about their role in your retirement. |

Points to Remember

- For many Americans, a great threat to their financial security in retirement is the risk of outliving their money.

- The first step in tackling longevity risk is to figure out a sustainable annual withdrawal rate from personal savings and investments.

- Next, consider keeping a cash reserve of 12 or more months to help pay for daily expenditures.

- Consider diversifying the rest of your taxable portfolio among different savings and investment options, including those with different maturities to account for fluctuating interest rates.

- Purchasing an immediate annuity with part of your nest egg can provide regular income and help address longevity risk.

- You may need to own some stocks to outpace inflation over the years.

- Work with a qualified financial professional to discuss retirement income strategies that might be appropriate for you.

Source/Disclaimer:

1Source: Social Security Administration, Period Life Table (2007, latest available).

2Certificates of Deposit (CDs) offer a guaranteed rate of return, guaranteed principal and interest, and are generally insured by the Federal Deposit Insurance Corp. (FDIC), but do not necessarily protect against the rising cost of living.

3Withdrawals from annuities prior to age 59½ are subject to a 10% additional tax and all withdrawals are taxed as ordinary income. Issuing companies may also charge surrender charges for some early withdrawals. Neither fixed nor variable annuities are insured by the FDIC, and they are not deposits of — or endorsed or guaranteed by — any bank. Investing in variable annuities involves risk, including loss of principal.

Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2016 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.