Business Succession Issues: Understanding Buy-Sell Agreements

Running into financial troubles isn’t the only reason that some closely held businesses fail to succeed. Their untimely demise may result from the lack of a formal plan providing for the orderly  succession of management and ownership of the business. Such a plan frequently incorporates a buy-sell agreement as the tool for ensuring that the business will continue even after the departure, death, or disability of an owner.

succession of management and ownership of the business. Such a plan frequently incorporates a buy-sell agreement as the tool for ensuring that the business will continue even after the departure, death, or disability of an owner.

To head off future problems, it pays to understand the uses and structures of these agreements. Although they can be adopted at any time, it is best to decide whether to put a buy-sell agreement in place as early as possible in the life of a business.

Legal Blueprint

A buy-sell agreement is a legal document allowing the remaining owner(s) to acquire the interest of a withdrawing shareholder or partner due to a specified event. The agreement usually restricts an owner’s ability to transfer his or her interest and sets out the terms under which another owner or the business entity may acquire the departing owner’s interest.

A buy-sell agreement can anticipate situations that could imperil the business or be harmful to owners and key employees. For example, it can be used to prevent unwanted outsiders or heirs from obtaining an ownership interest. It can prevent the continued involvement of retired or inactive shareholders or partners. It can ensure the legal continuation of the entity should an owner become bankrupt or lose a required professional license.

Among its benefits, a buy-sell agreement creates a marketplace for the shares of a closely held business, helps ensure that departing owners will receive adequate compensation, and provides cash to pay estate taxes and settlement costs for surviving heirs, if applicable. In fact, fixing the value of a business or establishing a procedure for valuing it in the future addresses one of the most important issues facing a closely held business. An agreement can also help increase job stability for minority owners and non-owner employees critical to the success of the business.

A buy-sell arrangement can be triggered by a variety of events. In addition to the death, disability, or retirement of an owner, other possible triggers may include an attempt to dissolve the entity, an irresolvable conflict among owners, or an owner’s desire to sell his interest.

Possible Structures and Funding

There are generally two basic types of buy-sell agreements:

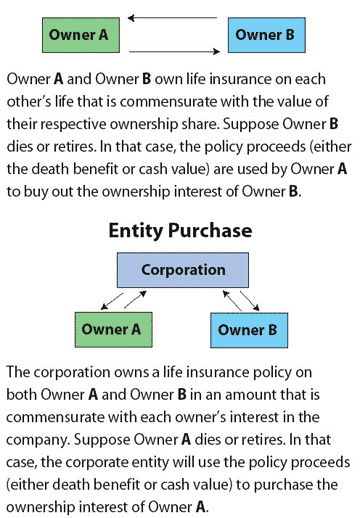

Cross purchase. Each owner enters into an agreement with every other owner. This approach becomes cumbersome if more than three or four individuals are involved. For example, 64 separate agreements would be required for eight owners.

Entity purchase. The business itself enters into an agreement with each owner and is obligated to buy the shares of a departing owner.

A third type, or so-called Hybrid plan, is essentially a combination of the cross purchase and entity purchase. This approach allows the entity and its owners to delay a purchase decision until a triggering event occurs. The entity typically has the first right of refusal for purchasing the shares of a departing owner.

Life insurance is the most popular funding mechanism for buy-sell agreements. Life insurance is unique in that it creates immediate funding in the event of death, while allowing tax-deferred cash to build up over time. In a cross purchase plan, each owner buys and maintains a policy on every other owner in an amount sufficient to cover the beneficiary’s ownership interest. In an entity arrangement, the business purchases the insurance policy on each owner and the business is the beneficiary.

Besides life insurance, other less popular but potentially effective funding mechanisms include cash flow, asset sales, loans, sinking funds, and reserves.

Tax and Estate Planning Considerations

Tax consequences are an essential consideration in determining whether to utilize a buy-sell agreement and how to structure one. This process involves evaluating the benefits and drawbacks of each type of arrangement in relation to the specific situation. For example, a cross purchase agreement offers shareholders a stepped-up basis on stock acquired in a buyout, and there are no alternative minimum tax (AMT) consequences if the business has C corporation status.

On the other hand, the cash value of any life insurance owned by the decedent that insures the life of another owner under a buy-sell agreement is includable in the decedent’s estate, which may affect estate taxes. Secondly, federal law precludes using a buy-sell agreement as a discounted giving technique.

Moreover, buy-sell agreements may be problematic for individuals looking to pass their business on to other family members if the agreement sets a price that is less than the fair market value of a deceased owner’s stock. If that were the case, then the entire amount of stock passed on to the surviving spouse would not qualify for the marital deduction. In addition, a child named in a buy-sell agreement who elects not to purchase a deceased parent’s shares may subject the surviving parent to gift taxes for the shares the child did not purchase.

An entity purchase plan has tax ramifications for the business itself. While death benefits are received tax free, life insurance cash values and death proceeds may result in corporate AMT. Also, insurance premiums are not a deductible business expense.

As this overview suggests, buy-sell agreements have many potential advantages. Among others, they can reduce conflicts, create a marketplace for shareholdings, and assure customers, suppliers, and employees that the business will continue. However, their complexities must be assessed, and agreements must be carefully crafted to address needs of the business, its owners, and their heirs. Input from qualified insurance, legal, and tax professionals is essential before entering into a buy-sell agreement.

Points to Remember

- A buy-sell agreement spells out what will be done with — and funds the transfer of — the ownership interest in a closely held business in the event of the death, disability, or withdrawal of an owner or partner.

- A buy-sell agreement can reduce disputes among those involved in a closely held business, as well as ensure the continuity of the business, by providing a fair process that protects departing owners, remaining owners, and the business itself.

- A buy-sell agreement may be structured as a cross purchase, entity purchase, or hybrid purchase plan. The choice of structure depends on the number of owners involved, as well as tax, estate planning, and other concerns specific to each situation.

- Life insurance is the most popular mechanism for funding a buy-sell agreement. The structure of the agreement determines whether individual owners or the business entity purchase the policies and receive their proceeds.

- Legal, tax, estate planning, and insurance professionals familiar with buy-sell agreements need to be consulted before deciding whether to employ an agreement and which structure it should use.

Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2015 Wealth Management Systems Inc. All rights reserved.