The Truth About Recessions

You know that a recession is coming, though the day and the hour is unknown even to the most savvy and information-infused economists. So it makes sense to get out of the way now, before it hits—right?

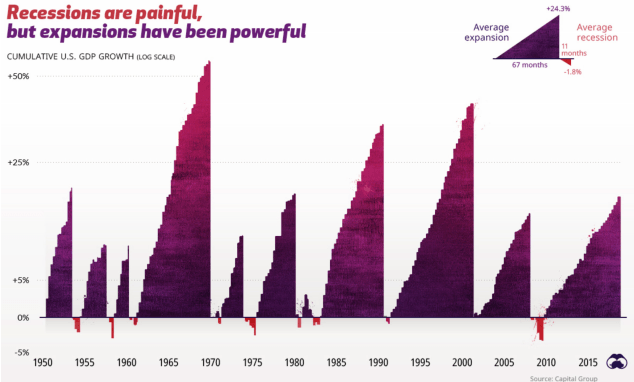

If that’s how you think, then you may be in danger of missing out on far more upside than the downside you’d be avoiding. A recent study by the Capital Group fund complex examined the size and duration of U.S. GDP expansions vs. contractions since 1950, and found (see graph) that, on average, expansions added 24.3% growth to the economy over (again on average) 67 month periods. The contractions were painful, but they only resulted in a loss of 1.8% of GDP, and lasted, on average, just 11 months. In other words, if we believe in past experience, the economy has tended to expand much longer and steeper than it has contracted.

You can see from the graph that not all recessions and expansions were the same. The contraction that began in 2008 (the read dip toward the right of the graph) was especially painful compared with the eight other recessions that Americans have experienced in the past 65 years. And recessions tend to cause a lot of pain while they last: they reduce income, industrial production and retail sales, and cause rising unemployment. The stock market is especially averse to recessions; you often find bear markets associated with recessions.

But what stands out in this graphical portrayal of economic growth vs. contraction is the much greater size of the expansions: the purple mounds greatly exceed in size and duration any of the contractions that we’ve experienced. In all, over the past six and a half decade, the U.S. has experienced an official recession for around 15% of all months—and you know that it will again, sooner or later. But I think we can also reasonably expect that the subsequent recovery will be longer and steeper than the downturn. The economy and the markets can be thought of as a rollercoaster that tends to rise more often than it falls.