Term vs. Permanent Life Insurance

Term vs. Permanent Life Insurance

When considering life insurance, one of the most important factors to understand is the difference between term and permanent insurance. Here’s an inside look at both.

Term and Perm

Term life insurance is temporary; it provides a death benefit for a specific term, such as 10, 20, or 30 years. Unlike other types of life insurance, it does not accumulate a cash value. If the policyholder dies during that term, his or her beneficiaries receive the benefit from the policy. When the contract ends, so does the coverage.

This limited term leads to term life insurance’s main advantage: price. Generally, term life insurance costs less than permanent life insurance, especially if the purchaser is younger. This has the potential to free up funds for other household expenses.

Permanent insurance remains in place as long as the policyholder makes payments. In addition, permanent policies are designed to build up “cash value,” a cash reserve that accumulates with the policy. Typically, this cash reserve pays a modest rate of return. However, the policyholder has limited access to the funds.

Which Should You Choose?

Term life insurance can be designed to provide protection against upcoming expenses, such as putting children through college. Permanent life insurance, on the other hand, can be more useful for covering long-term financial needs, such as estate planning.

Many people find that they have a combination of short- and long-term needs. In such circumstances, it may be prudent to have both types: A basic level of permanent life insurance supplemented by a term policy. A review of your situation may help determine what type of life insurance is appropriate.

Several factors will affect the cost and availability of life insurance, including age, health and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policy holder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

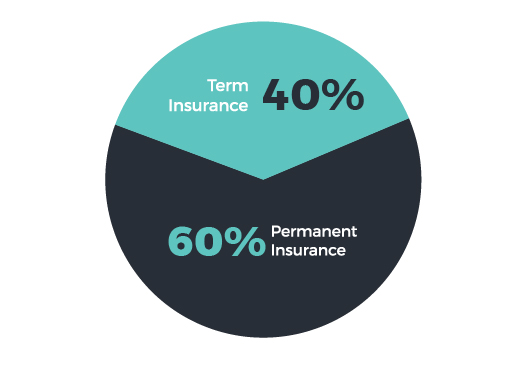

Term or Perm?

In 2012, (the most recent year for which statistics are available), people purchased more permanent life insurance policies than term life insurance policies.

Source: American Council of Life Insurers, 2014

- LIMRA, 2014

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG, LLC, to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2014 Faulkner Media Group.