The Consumer Mind: Millennial Spending

Millennial’s now make up a large part of the workforce, being one of the biggest generations ever and their spending habits have the power to change our future.

Our world is advancing at rapidly and it has majorly impacted one group of consumers: Millennials. Not only do they have more progressive values and opinions, but millennial spending habits are unique.

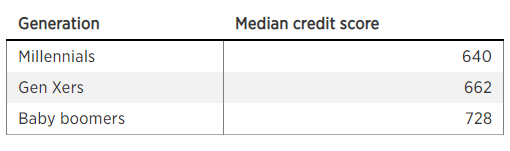

There are several factors influencing this age group, and an example is social media. Platforms like Instagram, Twitter or VSCO portray luxurious lifestyles. This causes many millennials to overspend while trying to keep up with other users. Along with that, this generation is in more debt than Generation X and the Baby Boomers (when they were age 23-35). See table below to compare credit scores.

Table 1.

Source: Forbes

Spending Habits

Millennial spending habits are drastically different than the generations before. The number of millennials purchasing homes is now only 37%. This is occurring because many underestimate the cost of upkeep or purchase in an expensive city. While some, simply can’t afford the down payment. Another possible reason is; millennial wealth is growing slower than their parents did. External factors causing the growth rate to decline are, lower salaries, student debt, and delayed marriage.

Recent research has shown that over 30% of millennials prioritize spending money on fine dining, or new technology instead of saving for retirement, (The Balance). Dining out at new or popular restaurant is a frequent millennial spending habit because of the experience that comes with it.

Millennials are also willing to spend more on technology or other luxuries, because 75% feel they are “competing with their friends in terms of clothing, cars, phones, and other extras,”(The Balance).

Despite the increase in unnecessary spending, 81% of millennial surveyed are confident in their financial choices. 34% feel financially secure because they have written out plans compared to “21% of Generation X’ers and 18% of Baby Boomers,” (The Balance) at that age.

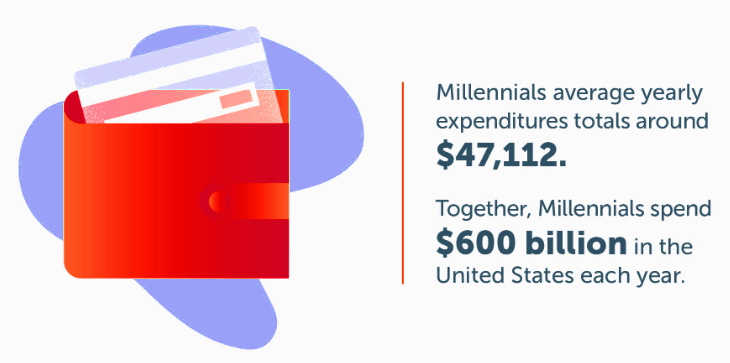

Source: Lexington Law

Purchasing Power

Due to the large size of this age group, millennials have the power to shift demand in various industries. They have already done this in the housing market, along with the food and travel industries. In 2017, millennials spent $200 billion alone, and in 2018 they were declared to have the most spending power of all generations, (Forbes).

This means that millennial spending clearly defines this generation’s interests which prioritize lifestyle, travel and convenience. In conclusion, millennial spending and their purchasing power is shaping our future, one dollar at a time.