Estimating the Cost of College

Estimating the Cost of College

It doesn’t take a degree in finance to see the cost of college continues to rise.

In its 2013 report, the College Board reported that public four-year institutions raised prices an average of 4.2% annually between the 2003-04 and 2013-14 school years. Put another way, a $5,000 education in 2003-04 is projected to cost $7,545 in 2013-14.

Tip: Public Costs. In–state tuition and fees for public four-year institutions averaged $8,893 for the 2013-2014 school year. Out-of-state tuition for these same institutions averaged $22,203.

Source: College Board, 2014

For a few families, the lion’s share of education costs falls on parents and, in some cases, on grandparents. Generally the majority of families rely on a combination of scholarships, grants, financial aid, part-time jobs, and parent support to help pay the cost.

Fast Fact: Private Costs. Tuition and fees for private four-year institutions averaged $30,094 for the 2013-2014 school year. If you add room and board, the figure rises to $40,917.

Source: College Board, 2014

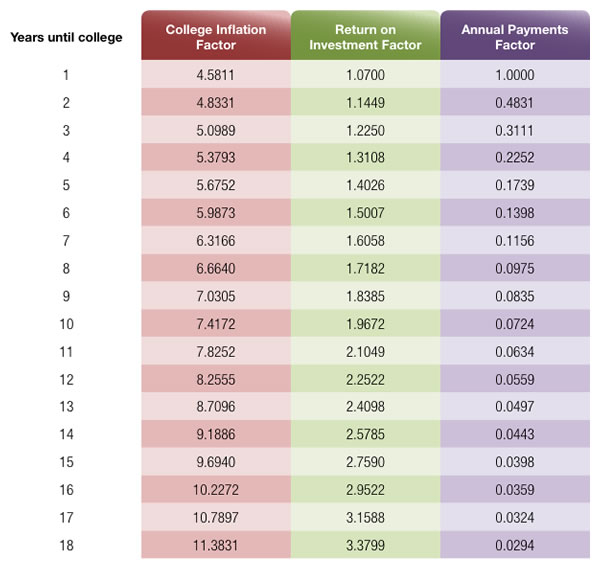

If your child is approaching college age, a good first step is estimating the potential costs. The accompanying worksheet can help you get a better idea about the cost of a four-year college.

If you’ve already put money away for college, the worksheet will take that amount into consideration. If you haven’t, it’s never too late to start.

Resources

There are a number of resources that can help individuals prepare for college. The U.S. government distributes certain information on colleges and costs. Here are two sites to consider reviewing:

www.college.gov

The government’s college portal

www.studentaid.ed.gov

The government’s financial aid portal

www.collegeboard.org

The group that administers the SAT test

Estimating the Cost of College

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2013 FMG Suite.