rebel Financial offers investment services for its on-going clients, not flat-fee clients. Learn more about our investment philosophy and various on-going services below with our Investment Management tools.

Investment Management

Our Process:

1. Engage us on any of our on-going client services

2. We will help you open accounts with your preferred custodians

3. With your advisor, determine your investment objectives & risk tolerance

4. Pick an investment style

Traditional

– Lowest cost & best investments without regard to other criteria.

– Default Investment Style.

Ultra-Low Cost

– New models using low-fee & no-fee ETFs.

– Net expense ratios under 0.10% for the entire portfolio.

Protection Plus

– Portfolios built with HY savings, Bonds, and guaranteed low-fee annuities.

– Increase your protection & potential guarantees while minimizing fees, surrender charges, & keeping your investments under our fiduciary oversight.

5. Review & evaluate over time to make sure your strategy is reaching its goal

Trading Front

TradingFront is part of our new “Ultra-low Cost” investing model which is coming out of Alpha and into Beta soon. This new model is made up exclusively of very low-fee ETFs and will drive fund expenses below 0.1%/yr. So, if you are a current client and interested in joining the waitlist to join our Beta, please sign up.

Join our BETA Wait-list

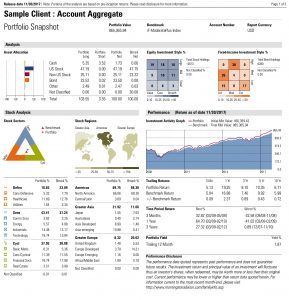

Morningstar Office

Morningstar is one of the largest third-party providers of independent investment research. Morningstar Office is the most complete advisor package that provides us with access to independent and detailed research for over 325,000 stocks, bonds, mutual funds, ETFs, closed-end funds, 529s, offshore funds, hedge funds, and separate accounts.

We’ve used technology to tie Morningstar Office into our direct custodians (TD Ameritrade, Schwab, Fidelity, and TIAA CREF). Our client’s investments/accounts feed directly through Morningstar, allowing us to monitor and manage accounts more effectively. These same systems and their integration with Morningstar’s immense research capabilities allow us to provide detailed and customized reporting to our clients at the push of a button with this investment management tool.

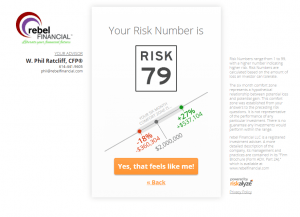

Riskalyze

Riskalyze is the second risk tolerance solution that we have adopted to help us better serve clients. Riskalyze is a solution that works to “gamify“ risk tolerance to make it more fun to comply with our need to update your risk tolerance. This helps us to better judge client mood/emotional changes that occur as the markets move and affect your account(s) so that we can better advise and guide you toward better investment management outcomes.

iRebal for TD Ameritrade

iRebal is a state-of-the-art, rule-based rebalancing application developed by TD Ameritrade. This allows us to automatically consider complex permutations of managing your account(s).

Hidden Levers

HiddenLevers uses big data to measure millions of relationships between the economy and investment managements.

HiddenLevers’ research team creates scenarios to model recessions, crises, and other economic events, using historical research and analysis on how economic indicators are correlated.

Innovative Technology

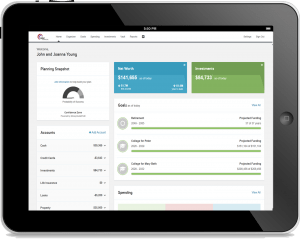

eMoney

EMoney, with the addition of the decision Center, our financial planning is much more dynamic and interactive, rather than the traditional boring and long financial plans of the past. Whether you want to evaluate retirement options, fund children’s education, build a solid estate plan, or just review your existing plan(s), all you need to do is enter your data into your rFPW and we’ll build your plan for you.

We have the expertise and the technology to help you visualize the cost and effect of your financial decisions – not just for today, but throughout your entire lifetime. Forward-thinking is what smart planning is all about. Let’s look forward together.

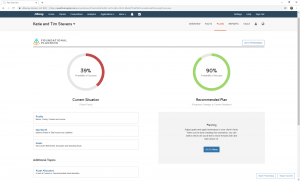

Foundational Planning

At rebel Financial, we believe in offering our clients cutting edge technology and software to give you not only a healthy investment portfolio but also convenient & timely financial planning and the peace of mind that comes with it. That’s why we’ve introduced Foundational Planning software to our financial planning arsenal. Foundational Planning follows a step-by-step workflow, focusing on retirement, education, and spending goals, combining them into one wholistic plan for the client. As clients‘ needs change, advisors can easily transition into using a more comprehensive planning solution, eliminating the need for multiple planning programs.

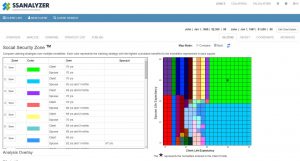

SS Analyzer

The SS Analyzer software has the power of published research behind it. It was founded by William Meyer and Dr. William Reichenstein who has written more than a dozen articles published in esteemed journals, like the Journal of Financial Planning and the Financial Analyst Journal. You can count on the accuracy of the SS Analyzer because it’s been validated by research and application.